Understanding the Career Consequences for Licensed Professionals

When you’re accused of business fraud, your first concern might be staying out of jail. But if you’re a licensed professional—a CPA, attorney, financial broker, healthcare provider, or real estate agent—the damage to your career can extend far beyond the courtroom.

A criminal conviction can lead to disciplinary action from your licensing board, including suspension, revocation, or permanent disqualification from practicing in your field. In some cases, even an arrest, charge, or investigation—without a conviction—can trigger scrutiny and disciplinary hearings.

At Simmons & Wagner, we understand the full weight of these consequences. As former Orange County District Attorneys, we now defend professionals facing business fraud allegations with not just their freedom—but their entire career—on the line.

Who’s at Risk?

These professions are especially vulnerable to license consequences after a fraud-related charge or conviction:

- CPAs and tax preparers (California Board of Accountancy)

- Attorneys (California State Bar)

- Real estate brokers and agents (California DRE)

- Healthcare providers (Medical Board of California, Board of Registered Nursing, etc.)

- Financial advisors, insurance agents, and securities professionals (FINRA, SEC, CDI)

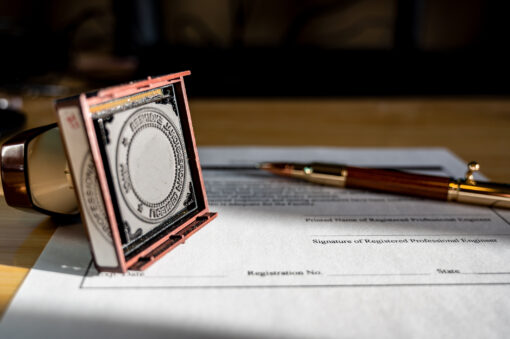

- Licensed contractors and engineers (CSLB, PE Board)

If you hold a professional license in California, any conviction involving dishonesty, misrepresentation, or financial impropriety could jeopardize your credentials.

How Licensing Boards React to Fraud Allegations

Even though licensing boards are administrative—not criminal—bodies, they take allegations of fraud seriously. Depending on your profession, they may:

- Launch their own investigation

- Summon you to a disciplinary hearing

- Request arrest or court records

- File a formal accusation

- Impose sanctions—whether or not you’re convicted

In many cases, your license board doesn’t wait for your case to resolve. You could face discipline while your criminal charges are still pending.

Common Collateral Consequences of a Conviction

- License suspension or revocation

- Mandatory reporting to clients, employers, or regulatory bodies

- Loss of certifications or credentials (e.g., Series 7, CPA, RN)

- Termination from employment

- Disqualification from government contracts or funding

- Reputational damage that limits future career prospects

Even if your conviction is eventually expunged, many boards still consider it in disciplinary decisions.

Not All Convictions Are Treated Equally

Boards often make a distinction between:

- Crimes involving “moral turpitude” (i.e., dishonesty or fraud)

- Crimes substantially related to your duties or qualifications

That means a fraud conviction—especially involving clients, money, or reporting—can be considered directly relevant to your fitness to practice.

For example:

- A CPA convicted of inflating revenue in a business deal

- A physician accused of billing fraud through a side venture

- An attorney who misappropriated partnership funds

- A broker who failed to disclose commissions or misled investors

In these cases, the board is likely to view the conduct as a fundamental breach of trust.

How Simmons & Wagner Protects Your Freedom—and Your License

Our defense strategy is always twofold:

- Prevent a criminal conviction or reduce the charges to something that won’t trigger license review

- Minimize reporting obligations and frame the outcome favorably for your licensing board

We work closely with licensing defense attorneys when needed, and we understand how to:

- Challenge the “fraud” narrative before it sticks

- Argue that your actions were negligent, not criminal

- Push for non-fraud alternatives like breach of contract, regulatory violations, or administrative penalties

- Pursue deferred prosecution agreements or dismissals that avoid guilty pleas

- Protect your professional reputation during and after the case

As former prosecutors, we know how to craft outcomes that satisfy the criminal court while limiting fallout with licensing bodies.

Don’t Wait Until It’s Too Late

If you’re licensed in California and facing fraud allegations—especially from a business deal, partnership dispute, or whistleblower claim—you need defense counsel who understands both the legal and professional risks.

At Simmons & Wagner, we help you protect your future, not just your record. Contact us today!

Whether you’ve already been charged or suspect you’re under investigation, contact us today for a confidential consultation.

We’ve been on the other side—and now, we’re on your side.